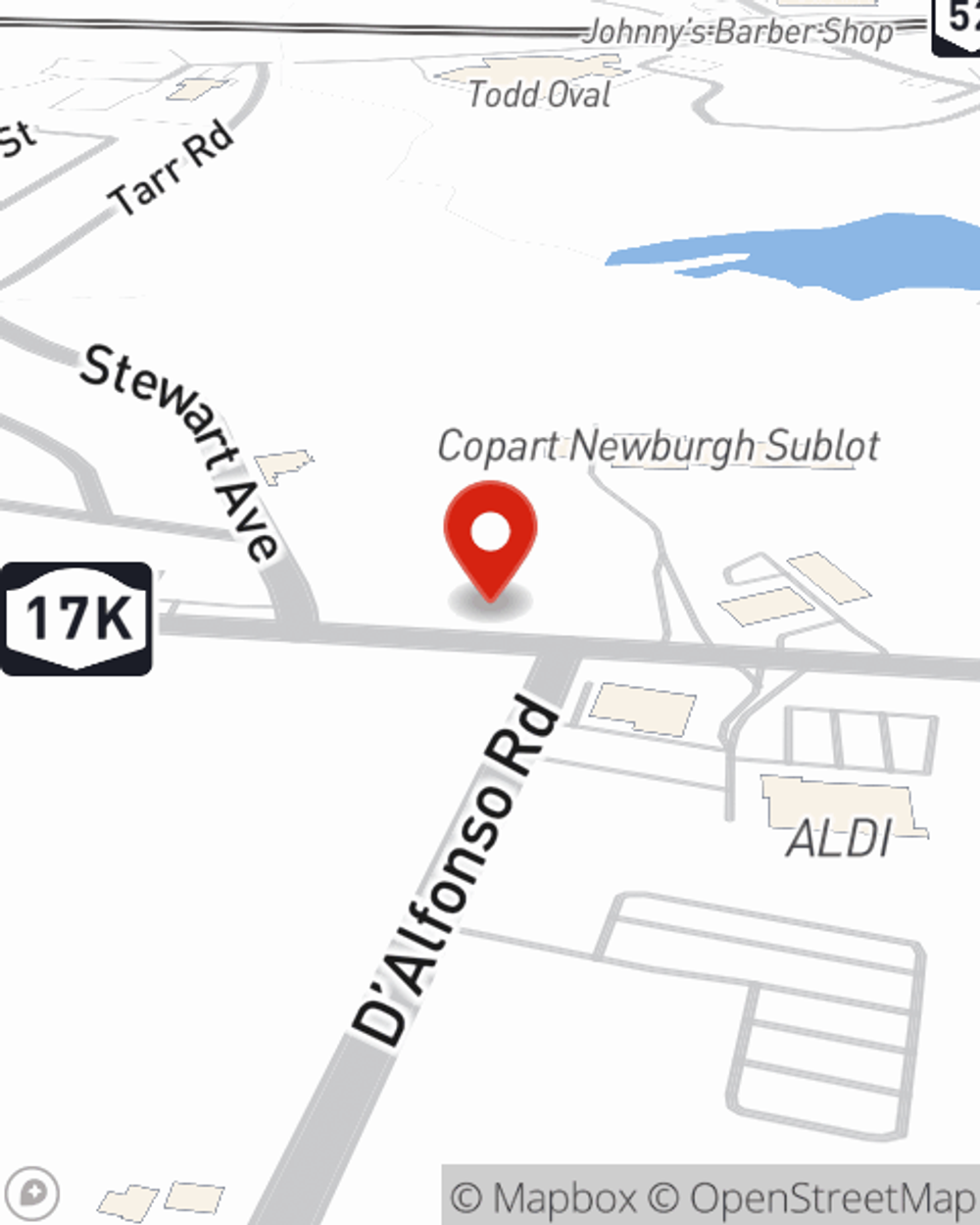

Business Insurance in and around Newburgh

Newburgh! Look no further for small business insurance.

Cover all the bases for your small business

- Newburgh

- New Windsor

- Beacon

- Monroe

- Poughkeepsie

- Middletown

- Kingston

- New Paltz

- Stony Point

- Nyack

- Goshen

- Warwick

- New Jersey

- Pennsylvania

- Mount Kisco

- Purchase

- White Plains

- Armonk

- Wappingers Falls

- Montgomery

- Walden

Help Protect Your Business With State Farm.

When experiencing the wins and losses of small business ownership, let State Farm do what they do well and help provide terrific insurance for your business. Your policy can include options such as a surety or fidelity bond, errors and omissions liability, and worker's compensation for your employees.

Newburgh! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

Whether you own a veterinarian, an arts and crafts store or a donut shop, State Farm is here to help. Aside from exceptional service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Wyatt Savage today, and let's get down to business.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Wyatt Savage

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.